Tobias Leander Welling, Infineon Technologies AG, WP7

In a growing globalization of production systems, handling the complexity of the supply chain becomes increasingly important. Especially the semiconductor industry faces challenges with high complex products, large product portfolios, short life cycles, long lead times and in general with a dynamic and competitive market environment (Mönch et al. 2018, Mousavi et al. 2019). Primarily, the long lead times decrease the flexibility offered to customers while ordering, since customers are encouraged to forecast their demand as accurate as possible before ordering. Since the forecasting is fluctuating and based on e.g. demand from OEMs, customers often cancel or change existing demand or even place new orders. On the one side, it occurs that customers request to have a product delivered earlier than the standard delivery time and could be willing to pay a higher price to make this happen (Öner-Közen and Ehm 2018). Whereas on the other side, customers cancelling orders are giving the reserved product quantities free to distribute to other customers.

In order to handle these challenges and in order to offer greater flexibility to the customer, Revenue Management can be applied. Used firstly by the airline industry in the late seventies, it first appeared in research of Rothstein and Littlewood (Rothstein 1971, 1974, Littlewood 2005). Revenue Management then made its way to the service industry and finally manufacturing industry, since here also manufacturing attributes such as inventory or capacity are perishable. So far, Revenue Management and Dynamic Pricing, a part of Revenue Management, have not yet played an important role in the semiconductor industry, but might hold a major advantage to generate greater flexibility for the customer. Dynamic Pricing describes the firm’s practice to charge different customers different prices for the same products, as an observable state of nature (Wittman and Belobaba 2018). However, customers may perceive lead time-based pricing negatively and doubt its fairness hence it is a new strategy in the industry. The hurdle lays in convincing customers to accept the contractual agreed lead time for the normal price and thus to pay a price premium for faster lead times (Öner-Közen and Ehm 2018).

Previously, the concept of Revenue Management has been solely applied on airline and service industries, but has not yet been practically implemented by any company in the semiconductor industry. However, it has been recently applied to other industries such as passengers railway companies (Ciancimino et al. 1999) or car rentals (Carroll and Grimes 1995). This might be due to its special characteristics such as a short term selling horizon, a CAPEX intensive production and high share of order changes (Chou 2014). First papers and theses analyze the approach of Revenue Management and Dynamic Pricing in the semiconductor industry, although they are mainly focusing on transferring the approach to this industry. Only the paper from Alexander Seitz proposes a robust supply chain planning network specifically designed for Revenue Management (Seitz et al. 2016).

After having presented the first necessary methods such as pricing algorithm, customer segmentation or a secure platform for applying Lead-time based pricing at a certain point in the far future, it is still necessary to evaluate the impact of this new approach on the entire supply chain. By selling products faster than their original standard delivery time, unknown effects might occur throughout the entire supply chain. In order to analyze these and to find ways to mitigate occurring problems, a simulation is needed. Through using the simulation software AnyLogic, an approach will be shown to simulate lead time-based pricing in the current supply chain framework.

The simulation is presented briefly in the following:

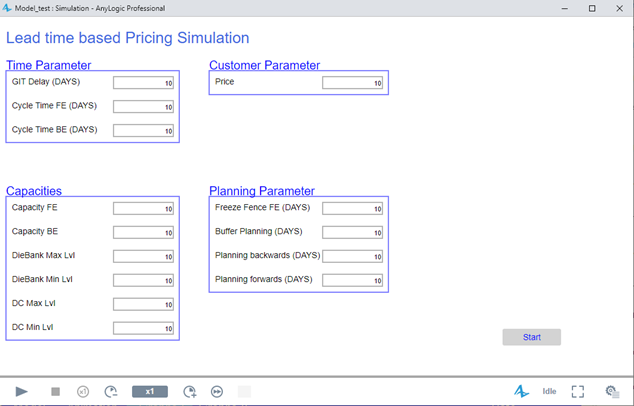

The simulation consist of a clearly structured user interface as seen in Figure 1. Here the use is able to insert the needed input parameters structured in time relevant, customer relevant, planning relevant parameters and capacities for the production entities. Consequently, the user is provided with enough flexibility to apply the simulation to different product lines or even different departments.

Figure 1: User Interface

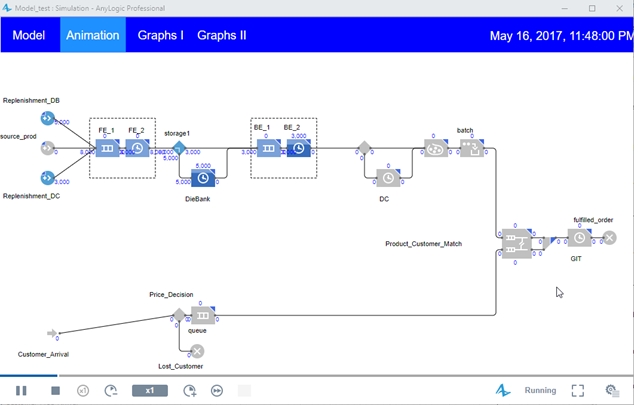

Following the simulation set-up page, is the simulation itself. In the simulation, the complete supply chain is mirrored using process library blocks. Customer are simulated separate from the products by using different agent types. Customers can be divided into price and lead-time sensitive customers. As such they feature different characteristics and different willingness to pay. The forecasting and prioritization of orders and respective products follows the same logic and pattern as in the real planning systems at Infineon Technologies. Having this ensured, the simulation results are comparable to a real-world application. The running simulation window can be seen in Figure 2.

Figure 2: Simulation Interface

In order to analyze the output of the model, several KPIs as well as parameters concerning the stock levels, the customer decisions, delivery performance and revenue changes are logged. In future, this platform can be used in order to analyze the impact of a certain share of specific lead-time sensitive customers on the current supply chain settings. Moreover, new insights might be developed for new supply chain setting that support lead-time based pricing as one method of Revenue Management. More information as well as the research results will be found in the Bachelor Thesis that is currently being written about the simulation model and in which the simulation itself has been developed so far.

The author would like to put emphasis on the fact that lead time based pricing is still a research topic that is investigated for a possible application in the far future. It may or may not be implemented.

References

Carroll, W.J. and Grimes, R.C., 1995. Evolutionary Change in Product Management: Experiences in the Car Rental Industry. Interfaces, 25 (5), 84–104.

Chou, C.-M., 2014. How does manufacturing service perceived value influence customer satisfaction? An investigation of global semiconductor industry. International Journal of Production Research, 52 (17), 5041–5054.

Ciancimino, A., et al., 1999. A Mathematical Programming Approach for the Solution of the Railway Yield Management Problem. Transportation Science, 33 (2), 168–181.

Littlewood, K., 2005. Special Issue Papers: Forecasting and control of passenger bookings. Journal of Revenue and Pricing Management, 4 (2), 111–123.

Mönch, L., Uzsoy, R., and Fowler, J.W., 2018. A survey of semiconductor supply chain models part III: master planning, production planning, and demand fulfilment. International Journal of Production Research, 56 (13), 4565–4584.

Mousavi, B.A., et al., 2019. Simulation-Based Analysis of the Nervousness within Semiconductors Supply Chain Planning: Insight from a Case Study. In: N. Mustafee, ed. 2019 Winter Simulation Conference (WSC). [Piscataway, NJ]: IEEE, 2396–2407.

Öner-Közen, M. and Ehm, H., 2018. Dynamic Price and lead time quotation under semiconductor industry related challenges, 3386–3396.

Rothstein, M., 1971. An Airline Overbooking Model. Transportation Science, 5 (2), 180–192.

Rothstein, M., 1974. HOTEL OVERBOOKING AS A MARKOVIAN SEQUENTIAL DECISION PROCESS. Decision Sciences, 5 (3), 389–404.

Seitz, A., et al., 2016. A robust supply chain planning framework for revenue management in the semiconductor industry. Journal of Revenue and Pricing Management, 15 (6), 523–533.

Wittman, M.D. and Belobaba, P.P., 2018. Customized dynamic pricing of airline fare products. Journal of Revenue and Pricing Management, 17 (2), 78–90.